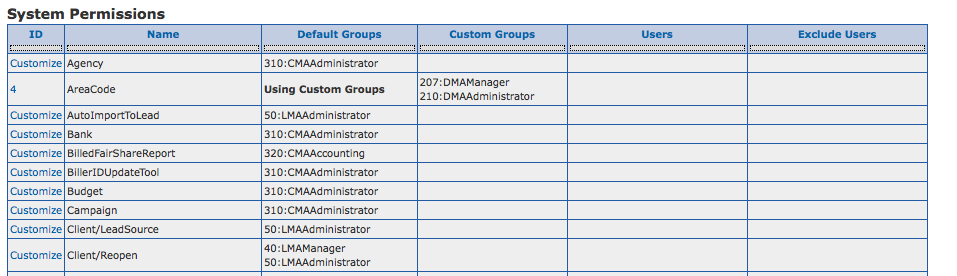

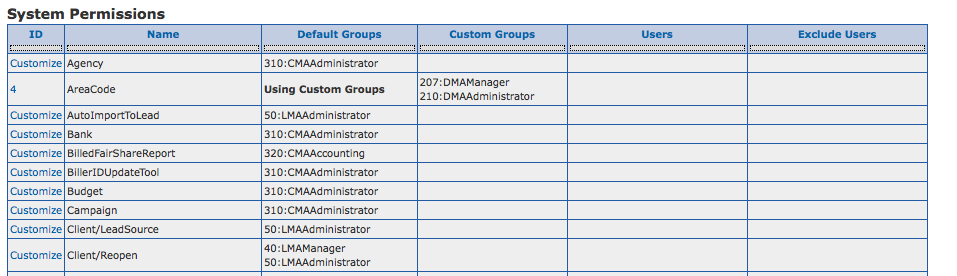

System Permissions enable customization of default access Groups to specific functionality within the CMA.

System Permissions are available under System Management.

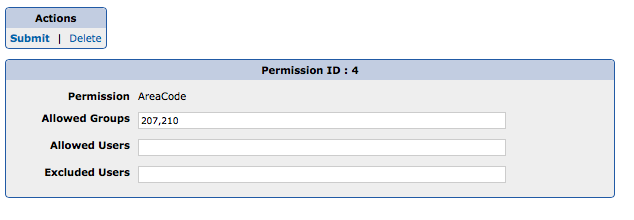

In this sample view, the name of the permission is listed along with the Default Groups specified by the System. The AreaCode permission has been customized to allow access to DMAManager and DMAAdministrator Groups. When Custom Groups are provided, they override the Default Groups.

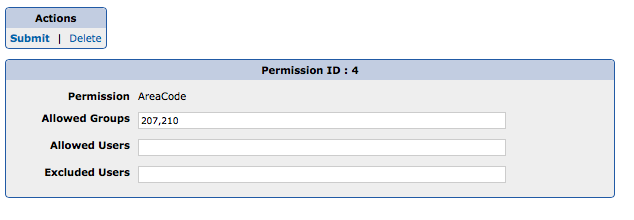

When customizing a permission, a comma delimited list of permission groups or Users are specified. Autocomplete is enabled in the fields, which allows typing of the Group or User names.

If Allowed Users are specified, the listed Users have access to the permission. This is in addition to the Default/Custom Groups.

Likewise, a list of Excluded Users indicates which Users will not have access to the permission.

To remove a customization, apply the Delete it.

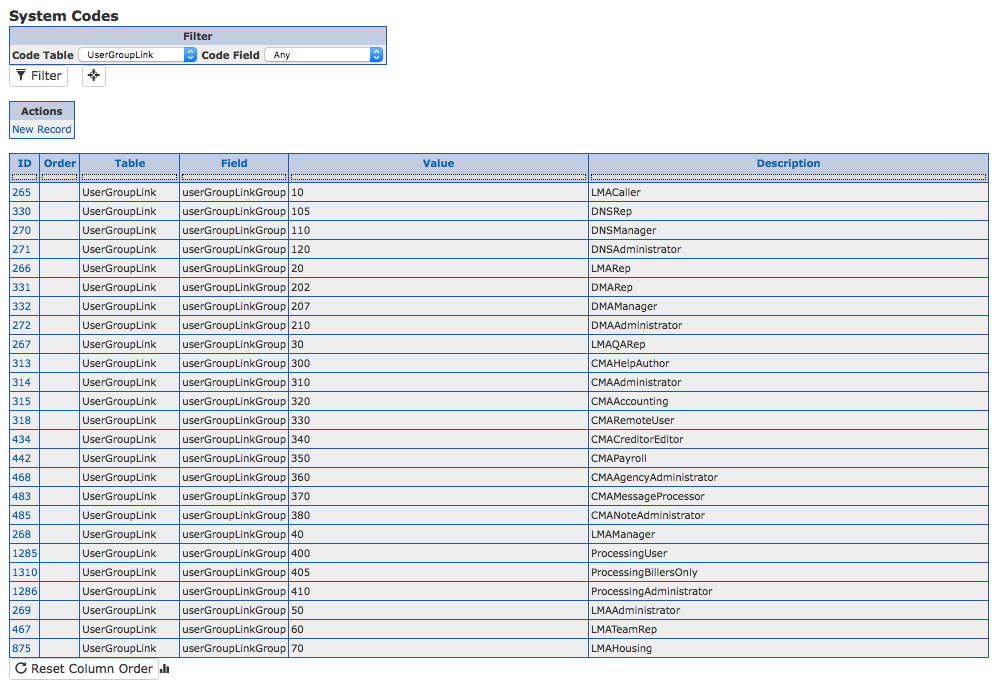

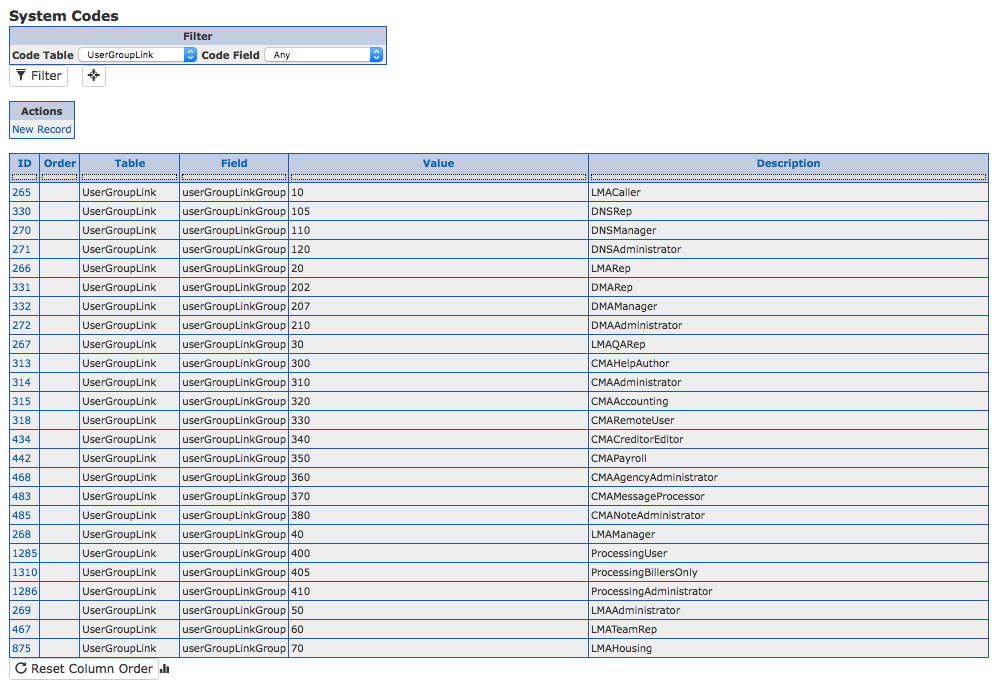

Creating Custom User Groups

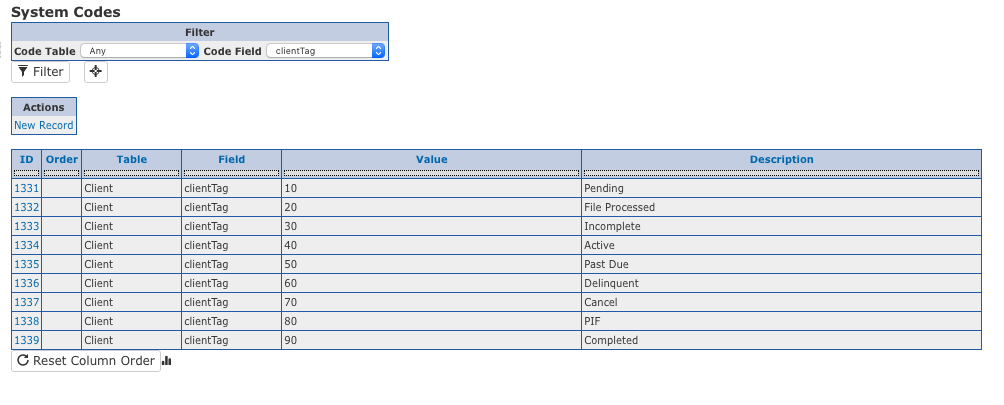

Custom User Groups may be created in the System Codes table.

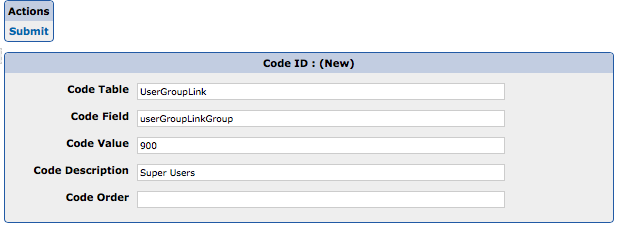

To add a custom Group, create a new Record, with a Table value of UserGroupLink, a Field value of userGroupLinkGroup, and a numeric Value. It is recommended that Custom Groups begin with a value of 900 to differentiate them from System Groups.

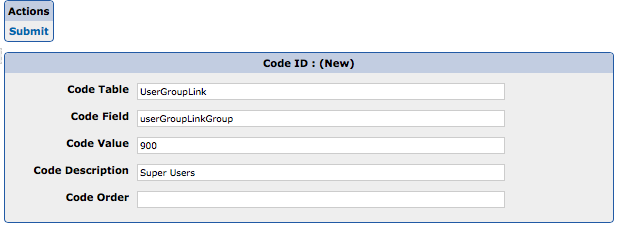

An example of a new User Group called, Super Users.

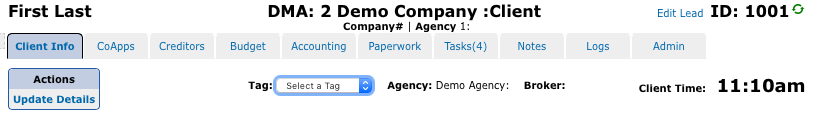

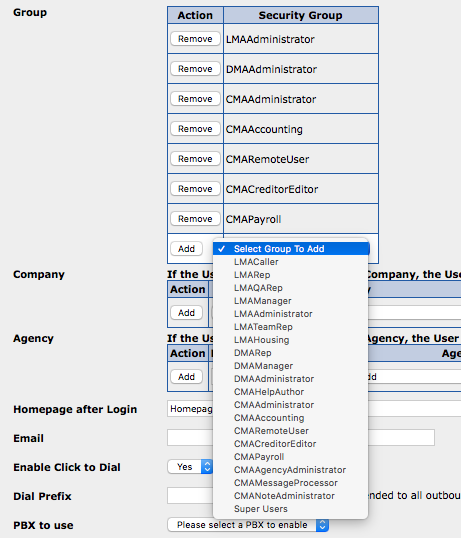

This new Group may now be assigned to Users and used as a Custom Group under System Permissions.

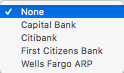

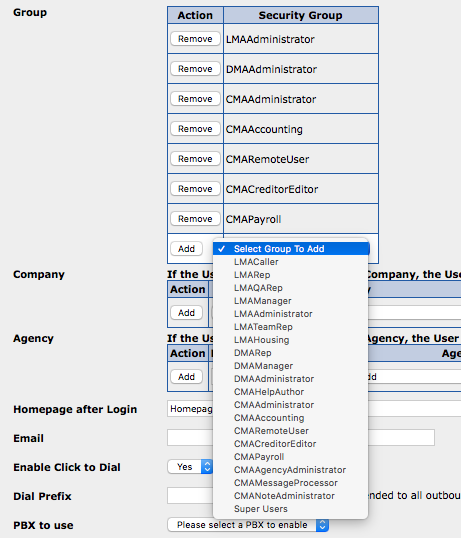

A view of available Groups when editing a User.

The combination of System Permissions and User Groups allows customization to access within the CMA.