Welcome to our quarterly blog post where we outline the enhancements, updates, and changes introduced to the CMA in version 24Q2. Here’s a comprehensive summary of what we’ve achieved in the past quarter:

Major Additions:

1. AI Task Analysis Engine:

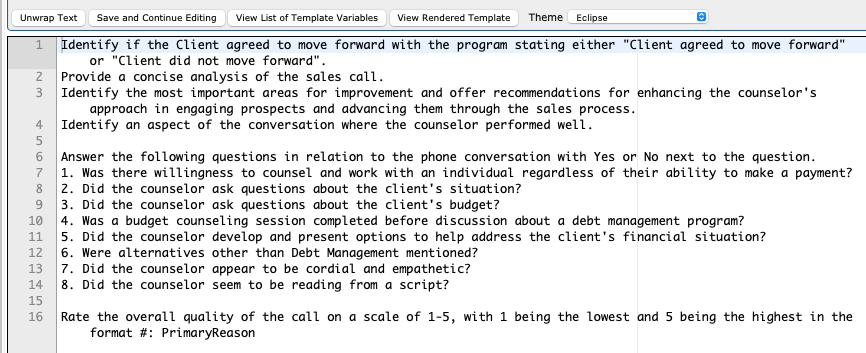

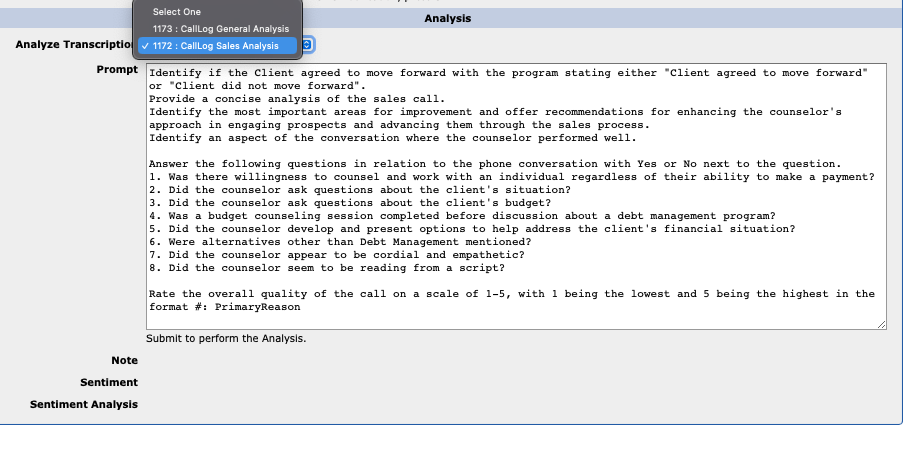

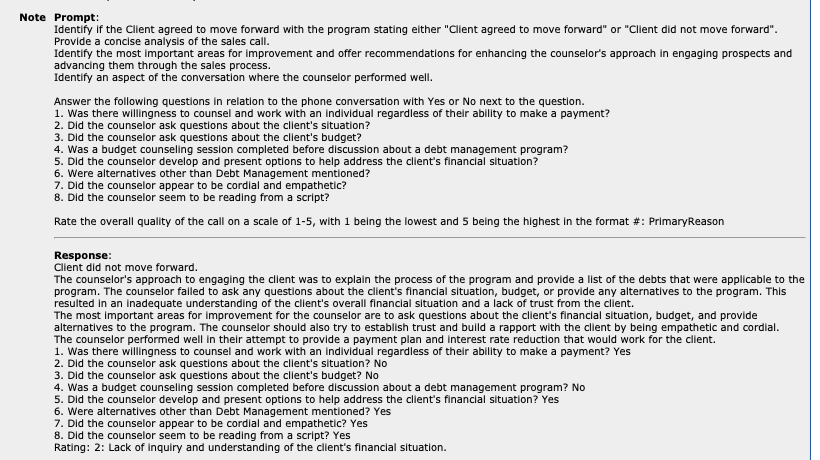

- A new feature that allows tasks to trigger dynamic AI prompts.

- Evaluates tasks using a Large Language Model and stores the results in ClientMessages.

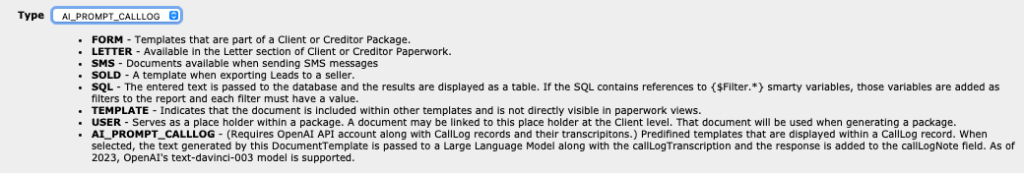

- Supports a new DocumentTemplate type: AI_PROMPT_TASK.

- Enhances task management by providing AI-generated insights directly linked to client interactions.

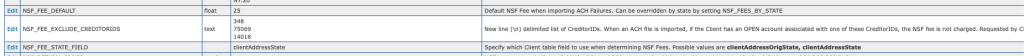

2. Dynamic DMP Payment Rule:

- Introduces a dynamic rule system for computing Debt Management Program (DMP) payments.

- Utilizes Smarty syntax within Creditor records for rule definition.

- Automatically computes payments for ClientCredit records based on these dynamic rules.

- Provides example rules and integrates loan term and account opening date fields for comprehensive payment calculations.

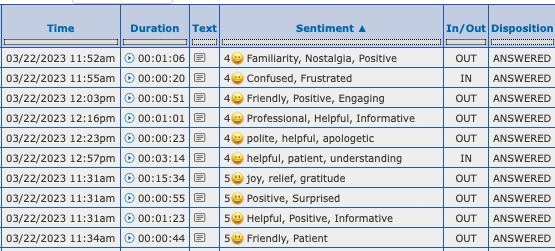

3. Link CallLog Records with ClientTasks:

- Automates the linking of CallLog records with the most relevant ClientTasks.

- Adds a new field callLogClientTaskID for this purpose.

- Enhances the Call Log Detail Report with new columns and filters for linked tasks.

- Improves performance and relevance by ensuring only related ClientTasks are considered.

Core Technology Updates:

- Upgraded to GPT-4o for better performance and cost-efficiency.

- Updated Apache to version 2.4.59 and PHP to 8.3.8.

- Integrated Smarty 4.5.3, @tabler/icons-webfont 3.6.0, ace-builds 1.35.0, jquery-ui 1.13.3, chart.js 4.4.3, and fullcalendar 6.1.14.

- Updated https://simplemaps.com/data/us-zips to version 1.85 (2024.04.30) for the latest ZIP code data.

Changes:

1. Data Management and Reporting:

- Added new education level options and a marital status option.

- Improved error messages and added information icons for better user guidance.

- Enhanced various reports with new fields and columns, including Phase TimeLine Report, Client Balance Report, and DMA Income Report.

- Updated Spinwheel Credit Profile and Credit Card columns for better organization.

- Introduced new filters and columns in LocateLead search view and other reports.

2. Task and Client Management:

- Enhanced logic linking CallLog records with ClientTasks for improved relevance and performance.

- Added more verbose error messages for CallLog transcription failures and optimized cron job performance.

- Improved scheduling logic for appointments, including fixing availability issues and optimizing the display of ‘Next Available Times.’

- Refined task outcome displays based on the taskOutcomes field, and updated default sort order of ClientTasks to show the most recently created open tasks first.

3. System and Performance Improvements:

- Optimized Peregrin Balance refresh and the computation of ClientCredit balance.

- Increased Disbursement Group range for better flexibility.

- Fixed various system errors, including those related to sending text messages, validation errors, and backend payment logic.

- Updated several system components and libraries for better performance and security, including PHP, Smarty, and various UI tools.

4. User Interface Enhancements:

- Improved the display of ClientTask notes, Client ACH records, and HUD Activity Type fields.

- Added color-coding for ‘No Show’ events and CSP Percentages for better visual management.

- Enhanced Appointment Calendar functionality with new features and better event visibility.

5. Error Handling and Security:

- Improved error messaging across different modules, including CallLog transcription, Equifax Credit Report responses, and Lead Import.

- Added security enhancements, including Subresource Integrity hashes and better security checks in EmailActivity.php.

- Fixed various display and logic issues, ensuring smoother user experience and system reliability.

This release brings continued enhancements and optimizations and furthers the system’s integration with the latest AI tools. Explore the new features and updates to maximize your productivity and streamline your workflows.